亲爱的CFA学员:欢迎来到融跃教育CFA官网!

距离 2025/5/14 CFA一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2020-04-09 09:31编辑:融跃教育CFA

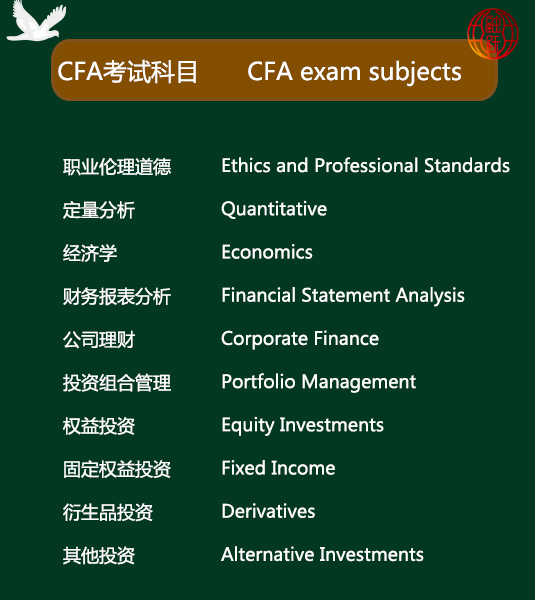

越来越多的人加入到CFA考试的大军中,那你知道CFA考试科目有哪些吗?考试科目都是金融知识吗?今天来讲一讲!CFA考试科目根据不同内容可以划分为3个课程框架,那它是怎么划分的呢?

【CFA考试课程框架】

1、基础框架:比如像道德,数量,以及经济学。

2、财务主导的框架:财务报表分析,公司理财,权益。

3、金融工具框架:固定收益,衍生品,其他类投资,以及投资组合管理。

可能大家不知道CFA考试科目涉及到哪些知识点和相关领域,接下来详细的分析一下,为考生解忧排难。

一、Ethical and Professional Standards(伦理和职业标准)

A. Professional Standards of Practice 专业实践标准

B. Ethical Practices 道德实践

二、 Quantitative Methods(定量方法)

A. Time Value of Money

B. B. Probability

C. Probability Distributions and Descriptive Statistics

D. Sampling and Estimation

E. Hypothesis Testin

F. Correlation Analysis and Regression

G. Time-Series Analysis

H. Simulation Analysis

I. Technical Analysis 技术分析

三、 Economics(经济学)

A. Market Forces of Supply and Demand

B. The Firm and Industry Organization

C. Measuring National Income and Growth

D. Business Cycles

E. The Monetary System

F. Inflation

G. International Trade and Capital Flows

H. Currency Exchange Rates

I. Monetary and Fiscal Policy

J. Economic Growth and Development

K. Effects of Government Regulation

L. Impact of Economic Factors>

四、 Financial Reporting and Analysis(财务报告与分析)

A. Financial Reporting System (with an emphasis>

B. Analysis of Principal Financial Statements

C. Financial Reporting Quality

D. Analysis of Inventories and Long-Lived Assets

E. Analysis of Taxe

F. Analysis of Debt

G. Analysis of Off-Balance-Sheet Assets and Liabilities

H. Analysis of Pensions, Stock Compensation, and Other Employee Benefits

I. Analysis of Inter-Corporate Investments

J. Analysis of Business Combinations

K. Analysis of Global Operations

L. Ratio and Financial Analysis

五、 Corporate Finance(企业融资)

A. Corporate Governance

B. B. Dividend Policy

C. Capital Investment Decisions

D. Business and Financial Risk

E. Capital Structure Decisions

F. Working Capital Management

G. Mergers and Acquisitions and Corporate Restructuring

六、 Equity Investments(股权投资)、

A. Types of Equity Securities and Their Characteristics

B. Equity Markets: Characteristics and Institutions

C. Equity Portfolio Benchmarks

D. Valuation of Individual Equity Securities

E. Fundamental Analysis (Sector, Industry, Company)

F. Equity Market Valuation and Return Analysis

G. Closely Held Companies and Inactively Traded Securities

H. Equity Portfolio Management Strategies

七、 Fixed Income(固定收益产品)

A. Types of Fixed-Income Securities and Their Characteristics

B. B. Fixed-Income Markets: Characteristics & Institutions

C. C. Fixed Income Portfolio Benchmarks

D. D. Fixed-Income Valuation (Sector, Industry, Company) and Return Analysis

E. Term Structure Determination and Yield Spreads

F. Analysis of Interest Rate Risk

G. Analysis of Credit Risk

H. Valuing Bonds with Embedded Options

I. Structured Products

J. Fixed-Income Portfolio Management Strategies

八、 Derivatives(衍生产品)

A. Types of Derivative Instruments and Their Characteristics

B. Forward Markets and Valuation of Forward Contracts

C. Futures Markets and Valuation of Futures Contracts

D. Options Markets and Valuation of Option Contracts

E. Swaps Markets and Valuation of Swap Contracts

F. Credit Derivatives Markets and Instruments

G. Uses of Derivatives in Portfolio Management

九、 Alternative Investments(另类投资)

A. Types of Alternative Investments and Their Characteristics

B. Real Estate Valuation

C. Private Equity/Venture Capital Valuation

D. Hedge Fund Strategies

E. Distressed Securities/Bankruptcies

F. Commodities and Managed Futures

G. Alternative Investment Management StrategiesG. Collectibles

十、 Portfolio Management and Wealth Planning(投资组合管理和财富规划)

A. The Investment Policy Statement

B. Modern Portfolio Management Concepts

C. Behavioral Finance

D. Management of Individual/Family Investor Portfolios

E. Management of Institutional Investor Portfolios

F. Investment Manager Selection

G. Economic Analysis and Setting Capital Market Expectations

H. Tax Efficiency Strategies

I. Asset Allocation

J. Portfolio Construction and Revision

K. Risk Management

L. Execution of Portfolio Decisions (Trading)

M. Performance Evaluation

下一篇:CFA考试科目财报在各级别中权重如何?基础前导课程有吗?

精品文章推荐

打开微信扫一扫

添加CFA授课讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的CFA课程?赶快联系学管老师,让老师马上联系您! 试听CFA培训课程 ,高通过省时省心!